CEMAC PERMITS

Any application for the grant of a mining title, authorization, permit or approval of a transaction shall be addressed to the Minister in charge of mines in triplicate, including one original stamp at the rate in force. The following documents shall be appended to the application:

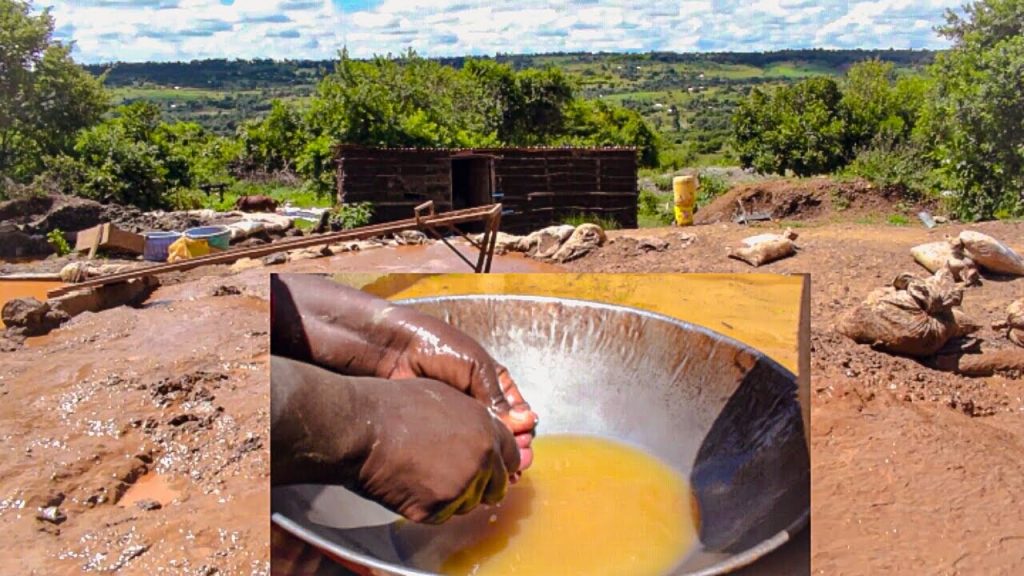

Is the CEMAC Buyers Permit Real or a scam

The CEMAC (Central African Economic and Monetary Community) Buyers Permit is indeed a legitimate document. It is issued for various purposes within the CEMAC region, which includes countries like Cameroon, Central African Republic, Chad, Congo, Equatorial Guinea, and Gabon. The permit is often required for specific types of transactions, including gold trade, to ensure compliance with regional regulations and standards.

Understanding the CEMAC Buyers Permit

- Purpose: The CEMAC Buyers Permit is designed to regulate and control the buying and selling of goods, including precious metals like gold, within the CEMAC member states. It helps ensure that transactions are conducted legally and transparently.

- Issuing Authority: The permit is typically issued by relevant governmental or regulatory bodies within CEMAC member countries. These authorities oversee trade and economic activities to prevent illegal practices and ensure compliance with regional laws.

- Regulations and Compliance: Obtaining a CEMAC Buyers Permit involves adhering to specific regulations, including providing documentation that verifies the legitimacy of the buyer and the source of the goods. This can include proof of business registration, financial statements, and compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Legitimacy: While the CEMAC Buyers Permit itself is real and necessary for conducting legitimate business within the CEMAC region, it is essential to be cautious of potential scams. Scammers may pose as officials or agents offering to facilitate the acquisition of such permits for a fee. Always verify the authenticity of the issuing authority and ensure that you are dealing with reputable and recognized entities.

How to Verify the Legitimacy of the Permit

Seek Professional Advice: If you are unsure about the legitimacy of a CEMAC Buyers Permit or the process of obtaining one, consider consulting with legal or trade professionals who specialize in the CEMAC region.

Check with Official Sources: Contact the relevant government or regulatory authorities in the specific CEMAC member country where you are conducting business. They can confirm the validity of the permit and provide guidance on the application process.

Research the Issuing Authority: Ensure that the issuing authority is officially recognized and operates within the legal framework of the CEMAC region. Avoid dealing with unknown or unverified entities.

Beware of Red Flags: Be cautious of any requests for payment or fees that seem unusual or excessive, especially if they come from unofficial channels. Legitimate authorities will have clear and transparent processes for issuing permits.

Understanding the Gold Export Permit: A Guide for Traders and Investors

Gold has long been a symbol of wealth and prosperity, making it one of the most traded commodities in the world. For traders and investors involved in the gold industry, understanding the legal framework surrounding gold export is crucial. One key component of this framework is the Gold Export Permit. This document is not only a legal requirement but also a vital element that ensures the legitimacy and smooth operation of gold trading across borders.

What is a Gold Export Permit?

A Gold Export Permit is an official document issued by the government or relevant authority of a country, granting permission to export gold from that country. This permit serves as proof that the gold being exported has been obtained legally and that all necessary taxes and fees have been paid. It also ensures that the export complies with international trade regulations and standards.

Why is a Gold Export Permit Important?

- Legal Compliance: Without a Gold Export Permit, exporting gold is considered illegal. The permit ensures that the gold has been sourced, processed, and prepared for export in compliance with the law. It helps prevent illegal mining and smuggling, which can have severe legal consequences for those involved.

- Quality Assurance: Obtaining a Gold Export Permit often involves verification of the gold’s purity and quality. This process ensures that the gold being exported meets the standards required by international markets, enhancing the credibility of the exporter.

- Facilitating International Trade: A Gold Export Permit simplifies the customs process, making it easier to navigate the complex regulations of different countries. It ensures that the export adheres to international trade agreements and minimizes the risk of disputes or delays.

- Building Trust with Buyers: Holding a valid Gold Export Permit reassures buyers that the gold has been sourced and exported through legitimate channels. This trust is crucial in maintaining long-term business relationships and securing future contracts.

Steps to Obtain a Gold Export Permit

The process of obtaining a Gold Export Permit varies from country to country, but it generally involves the following steps:

- Registration: The exporter must be registered with the relevant government authority, such as a mining or trade ministry. This may involve submitting documents that prove the legality of the business and its operations.

- Compliance with Local Laws: The exporter must comply with local mining laws and regulations, including the payment of any applicable taxes, royalties, or fees. This may also involve obtaining a certificate of origin to prove that the gold was mined or sourced legally.

- Application Submission: Once all necessary documents are in order, the exporter can submit an application for the Gold Export Permit. This application will typically include details about the quantity, quality, and destination of the gold.

- Inspection and Verification: The relevant authorities may conduct inspections to verify the accuracy of the information provided. This can include testing the gold’s purity and ensuring that it meets the required standards.

- Issuance of Permit: If the application is approved, the Gold Export Permit will be issued. The exporter can then proceed with shipping the gold to its destination.

Challenges in Obtaining a Gold Export Permit

While obtaining a Gold Export Permit is a straightforward process, it can be challenging due to:

Corruption and Bribery: In some regions, corruption can be a significant hurdle. Exporters may face demands for bribes or unofficial payments, which can complicate the process and lead to legal issues.

Bureaucratic Delays: In some countries, the process can be slow and cumbersome due to bureaucratic inefficiencies. It is essential to plan ahead and allow sufficient time for obtaining the permit.

Stringent Regulations: Some countries have very strict regulations regarding gold export, which can make the process more complex. Exporters must be familiar with these regulations to avoid delays or rejections.

Understanding the Gold Buyers License: Essential Information for Aspiring Gold Traders

In the world of gold trading, a Gold Buyers License is a critical document that allows individuals or businesses to legally purchase gold within a specific jurisdiction. This license is an essential requirement for anyone looking to engage in the buying, selling, or brokering of gold, ensuring that all transactions are conducted in compliance with local laws and regulations.

What is a Gold Buyers License?

A Gold Buyers License is an official permit issued by the government or a relevant regulatory body that authorizes an individual or company to legally purchase gold. This license is typically required for anyone who wishes to buy gold directly from miners, refineries, or other sellers, and it ensures that the buyer is operating within the legal framework set by the authorities.

Why is a Gold Buyers License Important?

- Legal Authorization: Without a Gold Buyers License, purchasing gold can be considered illegal, leading to severe penalties, including fines and imprisonment. The license provides legal authorization to engage in gold transactions and ensures that all activities are above board.

- Ensuring Fair Trade: The Gold Buyers License helps regulate the gold market by ensuring that only authorized and qualified buyers can participate. This regulation prevents illegal activities, such as money laundering or the purchase of conflict gold, which can have serious ethical and legal consequences.

- Building Credibility: Holding a Gold Buyers License enhances the credibility of a buyer in the eyes of sellers, banks, and financial institutions. It shows that the buyer is compliant with local regulations and committed to conducting business transparently and ethically.

- Facilitating Transactions: A Gold Buyers License simplifies the process of purchasing gold by providing a clear legal pathway. It enables the buyer to operate smoothly within the legal framework, reducing the risk of disputes or complications during transactions.

How to Obtain a Gold Buyers License

The process of obtaining a Gold Buyers License varies depending on the country or region, but it generally involves the following steps:

- Application: The first step is to submit an application to the relevant government authority or regulatory body. The application may require detailed information about the applicant’s business, including financial statements, business plans, and proof of identity.

- Background Check: Authorities may conduct a thorough background check on the applicant to ensure they have no criminal history or involvement in illegal activities. This check often includes a review of the applicant’s financial history and business dealings.

- Compliance with Regulations: Applicants must demonstrate that they are compliant with all local laws and regulations related to gold trading. This may involve registering the business, obtaining tax identification numbers, and adhering to anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Payment of Fees: A fee is usually required to process the application and issue the license. The cost can vary widely depending on the jurisdiction and the scale of the business.

- Issuance of License: Once the application is approved, the Gold Buyers License is issued, allowing the holder to legally purchase gold. The license may need to be renewed periodically, depending on the regulations of the specific region.

Challenges in Obtaining a Gold Buyers License

While obtaining a Gold Buyers License is a crucial step for anyone looking to enter the gold market, there are several challenges that applicants may face:

- Complex Regulatory Environment: The process can be complicated by varying regulations across different regions. Applicants must be well-versed in local laws and ensure that they meet all requirements to avoid delays or rejections.

- High Costs: The fees associated with obtaining a Gold Buyers License can be substantial, particularly for small businesses or individual traders. Additionally, there may be ongoing costs related to compliance and renewal of the license.

- Stringent Requirements: Some regions have very strict requirements for obtaining a Gold Buyers License, including extensive documentation, financial guarantees, and background checks. Meeting these requirements can be time-consuming and challenging.

- Corruption and Bureaucracy: In some areas, corruption and bureaucratic inefficiencies can make the process more difficult. Applicants may encounter demands for unofficial payments or face delays due to slow processing times.

Navigating the Gold Seller License: A Comprehensive Guide for Gold Traders

In the gold trading industry, a Gold Seller License is an essential authorization for individuals or businesses wishing to sell gold legally. This license ensures that sellers comply with regulatory standards, maintain transparency, and conduct transactions ethically. Here’s a detailed look at what a Gold Seller License entails, why it’s important, and how to obtain one.

What is a Gold Seller License?

A Gold Seller License is an official permit issued by a government authority or regulatory body that authorizes an individual or business to legally sell gold. This license is crucial for ensuring that all gold sales are conducted in accordance with local laws and regulations, providing a framework for fair and lawful trade.

Why is a Gold Seller License Important?

- Legal Compliance: A Gold Seller License ensures that the seller operates within the bounds of the law. Selling gold without this license can lead to legal repercussions, including fines and imprisonment. The license provides legal authorization for conducting gold sales.

- Consumer Protection: By holding a Gold Seller License, sellers demonstrate their commitment to transparency and ethical practices. This helps protect consumers from fraudulent activities, ensuring that they receive genuine, high-quality gold.

- Market Integrity: The license helps maintain the integrity of the gold market by regulating who can sell gold. This prevents illegal activities, such as the sale of conflict gold or gold from unverified sources.

- Building Trust: A Gold Seller License enhances the credibility of the seller, fostering trust among buyers, financial institutions, and regulators. It signals that the seller is compliant with industry standards and committed to ethical business practices.

How to Obtain a Gold Seller License

The process for obtaining a Gold Seller License varies depending on the country or region but generally includes the following steps:

- Application Submission: Start by submitting an application to the relevant government authority or regulatory body. The application will require information about the applicant’s business, including its legal structure, financial status, and operational details.

- Compliance Checks: Authorities will conduct a thorough review to ensure that the applicant complies with all local regulations related to gold trading. This may include verifying the source of the gold, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements, and checking the applicant’s background.

- Documentation: Applicants may need to provide various documents, such as proof of business registration, tax identification numbers, financial statements, and evidence of adherence to regulatory standards.

- Fee Payment: There is usually a fee associated with obtaining a Gold Seller License. The cost can vary based on the jurisdiction and the scale of the business. Ensure that all fees are paid promptly to avoid delays.

- Inspection and Approval: Some jurisdictions may require an inspection of the business premises to verify compliance with regulations. Once all requirements are met and the application is approved, the Gold Seller License will be issued.

- License Renewal: The Gold Seller License may need to be renewed periodically, depending on local regulations. Be sure to keep track of renewal dates and comply with any additional requirements to maintain the validity of the license.

Challenges in Obtaining a Gold Seller License

Obtaining a Gold Seller License can be challenging due to several factors:

- Regulatory Complexity: Different regions have varying regulations and requirements for gold sellers. Navigating these regulations can be complex and may require expert advice or assistance.

- Cost: The application and maintenance costs for a Gold Seller License can be significant, particularly for small businesses or individual sellers. Budgeting for these costs is essential.

- Bureaucratic Processes: The process of obtaining a license can be slowed by bureaucratic inefficiencies or lengthy approval times. Patience and careful preparation are required to navigate these challenges.

- Compliance Requirements: Meeting all compliance requirements, such as AML and KYC standards, can be demanding. Sellers must ensure that their practices align with regulatory expectations to avoid penalties.

The Accredited Gold Buyer Passport: What You Need to Know

In the gold trading industry, the term “Accredited Gold Buyer Passport” refers to a specialized certification or credential that verifies an individual’s or company’s ability to purchase gold in compliance with industry standards and regulations. This passport is crucial for buyers who wish to engage in high-value transactions and build credibility within the market. Here’s a comprehensive overview of what the Accredited Gold Buyer Passport entails, its significance, and how to obtain one.

What is an Accredited Gold Buyer Passport?

The Accredited Gold Buyer Passport is a certification that verifies the legitimacy and credibility of an individual or entity in the gold buying sector. It acts as an official endorsement that the holder meets specific standards and qualifications set by industry regulators or recognized organizations. This passport is often required for buyers involved in large-scale transactions or international trade.

Why is the Accredited Gold Buyer Passport Important?

- Verification of Legitimacy: The passport verifies that the holder is a legitimate buyer, reducing the risk of fraud and ensuring that transactions are conducted with reputable parties.

- Facilitating International Trade: For international gold transactions, the passport helps facilitate smoother interactions by providing a recognized and trusted credential that complies with global standards.

- Building Trust and Credibility: Possessing an Accredited Gold Buyer Passport enhances the buyer’s reputation and trustworthiness. It signals to sellers, financial institutions, and regulatory bodies that the buyer adheres to industry best practices.

- Compliance with Regulations: The passport ensures that the buyer complies with relevant regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements, which are crucial for legal and ethical gold trading.

How to Obtain an Accredited Gold Buyer Passport

The process for obtaining an Accredited Gold Buyer Passport typically involves several steps:

- Application: Submit an application to the accrediting body or organization responsible for issuing the passport. The application will include detailed information about the buyer’s business, financial status, and trading history.

- Background Check: The accrediting body will conduct a thorough background check to verify the buyer’s legitimacy. This includes reviewing financial records, business operations, and any past involvement in gold trading.

- Documentation: Provide necessary documentation, such as proof of business registration, tax identification numbers, financial statements, and evidence of compliance with AML and KYC regulations.

- Training and Certification: Some accrediting bodies may require the buyer to undergo training or certification programs related to gold trading practices, regulatory compliance, and ethical standards.

- Fee Payment: Pay any fees associated with the application and issuance of the Accredited Gold Buyer Passport. The cost can vary depending on the accrediting body and the scope of the certification.

- Approval and Issuance: Once all requirements are met and the application is approved, the Accredited Gold Buyer Passport will be issued. This passport may need to be renewed periodically, depending on the policies of the accrediting body.

Challenges in Obtaining an Accredited Gold Buyer Passport

Securing an Accredited Gold Buyer Passport can present several challenges:

- Regulatory Complexity: Different accrediting bodies may have varying standards and requirements, making the process complex and time-consuming. Buyers need to ensure they meet all specific criteria.

- Cost: The application and certification fees can be substantial, especially for smaller buyers or those new to the gold market. Budgeting for these expenses is important.

- Documentation Requirements: The extensive documentation required can be cumbersome to gather and prepare. Buyers must ensure all documents are accurate and complete to avoid delays.

- Compliance with Standards: Meeting all regulatory and compliance standards can be demanding. Buyers must stay informed about industry best practices and legal requirements to maintain their accreditation.

CEMAC Buyers Permit is a real and necessary document for conducting trade within the region, it is crucial to verify the legitimacy of any offers or processes related to obtaining it to avoid falling victim to scams, contact us now