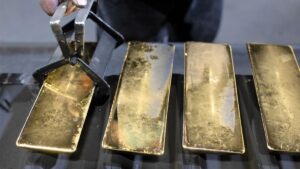

Discovering Where Gold Shines the Brightest: Which Country Offers the Cheapest Gold?

Gold has always captivated human imagination, symbolizing wealth, power, and timeless beauty. Its allure is evident across cultures and generations, making it a popular investment and a treasured asset. But with the global gold market fluctuating, have you ever wondered where you can find the cheapest gold? Let’s explore some countries where you might get the best value for your gold investments.

- India: The Land of Gold

India is renowned for its deep cultural connection with gold, often seen in traditional jewelry and ceremonies. The country’s demand for gold is incredibly high, which can sometimes drive up prices. However, due to high competition among jewelers and lower import duties for gold, India can offer competitive prices, especially in large metropolitan areas like Mumbai and Delhi. The country also has a vibrant market for gold bullion and coins, providing ample opportunities for both investors and collectors.

- United Arab Emirates (UAE): The Gold Hub

Dubai, in particular, is famous for its gold markets, including the Gold Souk in Deira. The UAE’s strategic location as a major trading hub and its low import duties on gold contribute to relatively lower prices. The UAE’s tax-free environment and its large number of gold traders create a highly competitive market, which can result in better prices for buyers.

- Singapore: The Bullion Paradise

Singapore has emerged as a significant player in the global gold market due to its status as a financial hub with a robust regulatory environment. The country’s zero percent Goods and Services Tax (GST) on investment-grade gold bullion makes it an attractive destination for investors. The absence of taxes on gold makes Singapore an excellent place for purchasing gold bars and coins at relatively lower prices compared to other markets.

- Hong Kong: The Gold Sanctuary

Hong Kong is another major center for gold trading, offering competitive prices due to its low taxation on precious metals. The Special Administrative Region of China has a well-established gold trading infrastructure and minimal taxes on gold purchases. The city’s status as a global financial center and its open market policies help keep gold prices relatively low.

- South Africa: The Gold Mine

South Africa is one of the world’s largest producers of gold. The proximity to gold mines and the robust mining industry contribute to relatively lower gold prices within the country. However, fluctuations in the local currency and other economic factors can influence prices. South Africa offers an interesting option for those looking to buy gold locally and potentially benefit from lower costs due to reduced transportation expenses.

Key Considerations

While these countries may offer competitive gold prices, it’s essential to consider other factors before making a purchase:

Can You Buy Gold In Europe

Absolutely, you can buy gold in Europe, and there are several avenues available depending on what you’re looking for. Whether you’re interested in investing in gold bullion, coins, or jewelry, Europe offers a diverse range of options. Here’s a quick guide to buying gold in various European countries:

1. United Kingdom

- Bullion Dealers: London is a major hub for gold trading, with several well-known bullion dealers such as BullionByPost and The Royal Mint.

- Coins and Bars: The UK offers a wide range of gold coins and bars, including those minted by The Royal Mint.

- Tax Considerations: Gold bullion and coins are exempt from VAT in the UK, making it an attractive option for investors.

2. Germany

- Gold Dealers: Germany has a robust gold market, with reputable dealers such as Degussa and GoldSilberShop.

- Coins and Bars: German dealers offer various gold products, including the popular 1-ounce Gold Philharmonic coins.

- Tax Considerations: Gold bullion and coins are exempt from VAT in Germany if they are considered investment-grade.

3. Switzerland

- Gold Dealers: Switzerland is known for its secure and high-quality gold market, with dealers like PAMP Suisse and Credit Suisse.

- Coins and Bars: You can find a variety of gold bars and coins, and Switzerland is famous for its high-purity gold products.

- Tax Considerations: Gold is VAT-exempt in Switzerland, making it a favorable location for purchasing gold.

4. France

- Gold Dealers: Paris and other major cities have several reputable gold dealers such as AuCOFFRE and CPoR Devises.

- Coins and Bars: France offers a range of gold investment products, including the French gold coin, the Napoléon.

- Tax Considerations: Investment-grade gold is exempt from VAT in France.

5. Italy

- Gold Dealers: Italy has numerous gold dealers and markets, particularly in cities like Rome and Milan.

- Coins and Bars: You can purchase a variety of gold coins and bars in Italy, including some that feature Italian designs.

- Tax Considerations: Investment-grade gold is typically exempt from VAT in Italy.

6. Spain

- Gold Dealers: Madrid and Barcelona are home to several gold dealers, such as Oro Direct.

- Coins and Bars: Spain offers various gold coins and bullion options.

- Tax Considerations: Gold bullion and investment-grade coins are generally exempt from VAT in Spain.

Key Considerations for Buying Gold in Europe

- Authenticity: Ensure you buy from reputable dealers who provide certification of authenticity.

- Purity: Verify that the gold is of the required purity, typically 99.9% for investment-grade gold.

- VAT and Taxes: Investment-grade gold is often exempt from VAT in many European countries, but always check local regulations.

- Market Prices: Prices can vary based on market conditions, so it’s wise to compare prices from different dealers.

Conclusion

Europe provides a wealth of options for buying gold, with many countries offering competitive prices and favorable tax conditions for investment-grade gold. Whether you’re interested in bullion, coins, or jewelry, Europe’s well-established gold market ensures you have access to high-quality products and reliable dealers. Just be sure to do your research and make informed decisions to get the best value for your investment.