How to Buy Gold from Cameroon Safely: Legal Process, Permits, and Trusted Dealers

Updated 2025 Guide by BonasGold

BonasGold is your trusted African gold dealer, offering secure, legal, and transparent gold transactions. This guide explains everything you need to know to buy authentic gold from Cameroon—legally, safely, and efficiently. From permits to certified dealers, storage options, and international shipping, we cover all critical aspects for buyers worldwide.

Legal Framework for Buying Gold in Cameroon

Gold and mineral trading in Cameroon is strictly regulated by the Ministry of Mines, Industry, and Technological Development (MINMIDT). Compliance with CEMAC (Economic and Monetary Community of Central Africa) regulations is mandatory for legal transactions.

To ensure your investment is legitimate, all buyers must:

- Obtain a CEMAC Buyer’s Permit

- Verify sellers’ licenses

- Secure export authorizations for international shipments

Official MINMIDT resources for verification and guidance:

Buyer’s Permit: The First Step to Legal Gold Trading

Before purchasing gold in Cameroon, a CEMAC Buyer’s Permit is required. This ensures legal permission to buy gold from certified dealers and prevents fraud.

Permit Details (2025):

- 1–5 Year Buyer’s Permit: $7,500 USD

- 2-Year Extended Permit: $10,000 USD

Apply and learn more here:

Documents to Verify Before Buying

Always confirm that the seller provides:

- Valid CEMAC Buyer’s Permit (your own)

- Seller’s MINMIDT-issued license

- Export authorization for international shipments

Avoid scams by verifying documents through official sources:

Where to Buy Gold in Cameroon

Cameroon is rich in gold deposits, particularly in Batouri, Bertoua, and the East Region. To avoid fraud, purchase only from certified suppliers.

BonasGold is a government-recognized exporter with over 20 years of experience and full legal compliance.

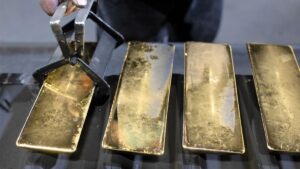

Gold Products Available:

Gemstones and Other Precious Metals:

Avoiding Scams: Key Buyer Tips

- Verify Licenses and Certificates – always check seller documents

- Use Licensed Exporters Only

- Avoid Unrealistic Prices – if it seems too good to be true, it probably is

Learn more from BonasGold’s anti-fraud guide:

Why Buy Physical Gold from Cameroon?

Pros:

- Tangible, real-world asset

- Intrinsic value protection

- No counterparty risk

- Globally storable

Cons:

- Requires secure storage

- Insurance costs apply

Secure Gold Storage Options:

- Home Storage: Safes or hidden compartments (risk: theft)

- Professional Vault Services: Insured, audited, and secure (fees apply)

Learn more: How to Store Gold Safely

Global Buying Guides

BonasGold helps buyers worldwide, with country-specific guides:

- Buy Gold from Africa to Romania

- Buy Gold from Africa to Bulgaria

- Import Gold to Dubai

- UK Buyers Step-by-Step Guide

- Import Gold to Australia

- Buy Gold from Africa to Hong Kong

Other African country guides:

Additional Resources

- Gold Order Process from Cameroon: Guide for Buyers

- Authentic African Gold for Sale

- Cheapest Way to Buy Gold Online from Africa

- How to Legally Import Gold from Africa

Official CEMAC Resources:

Contact BonasGold

🌐 Website: https://bonasgold.net

📧 Email: [email protected]

📱 WhatsApp / Call: +237 675 915 154

BonasGold – Transparent, legal, and safe African gold supplier serving clients across Europe, America, UAE, and Asia.