Your Ultimate Guide to Buying Gold Near Me: Tips, Trends, and Trusted Sources

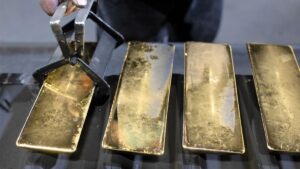

Gold has always been a symbol of wealth and stability. Whether you’re an investor looking to diversify your portfolio or someone wanting a timeless piece of jewelry, knowing how to buy gold locally can offer convenience and confidence. In this blog post, we’ll walk you through everything you need to know about buying gold near you—from finding reputable dealers to understanding market trends.

1. Why Buy Gold Locally?

Buying gold locally has several advantages. For one, it allows you to inspect the gold in person, ensuring its quality and authenticity. Additionally, local purchases can often be completed more quickly than online transactions, and you may save on shipping costs. Local dealers may also offer personalized service, which can be invaluable if you’re new to buying gold.

2. How to Find Reputable Gold Dealers Near You

a. Research Online: Start by searching for gold dealers in your area. Websites like Yelp, Google Maps, and the Better Business Bureau can provide reviews and ratings that offer insights into a dealer’s reputation.

b. Visit Local Jewelry Stores: Many jewelry stores sell gold, whether in the form of bullion, coins, or jewelry. Established jewelers often have a solid reputation and can provide certificates of authenticity.

c. Check with Pawn Shops: While pawn shops might offer competitive prices, they vary widely in reliability. Ensure that the pawn shop is well-reviewed and transparent about the gold’s quality and pricing.

d. Attend Local Coin Shows: Coin shows are great places to meet multiple dealers and compare prices. These events also allow you to ask questions and get a feel for the market.

3. Understanding Gold Pricing

Gold prices fluctuate daily based on market conditions. Familiarize yourself with the current spot price of gold, which is the price for one ounce of pure gold. Websites like Kitco and the London Bullion Market Association (LBMA) provide up-to-date spot prices.

a. Premiums Over Spot Price: Dealers typically charge a premium over the spot price to cover their costs and make a profit. This premium can vary depending on the form of gold you’re buying (e.g., coins, bars, jewelry) and the dealer’s markup.

b. Checking Gold Purity: Gold purity is measured in karats (for jewelry) or fineness (for bullion). Pure gold is 24 karats or 999.9 fineness. Ensure that the gold you purchase is properly stamped and comes with certification if it’s a high-value item.

4. Questions to Ask Your Local Gold Dealer

When considering a purchase, don’t hesitate to ask questions. Here are some you might consider:

- What is the current spot price of gold?

- What premium are you charging over the spot price?

- Can you provide a certificate of authenticity?

- What is your return policy?

- Are there any additional fees or taxes?

5. Ensuring a Safe Transaction

a. Verify the Dealer’s Credentials: Check for any certifications or memberships in industry associations like the Numismatic Guaranty Corporation (NGC) or the Professional Coin Grading Service (PCGS).

b. Get a Written Receipt: Always ask for a detailed receipt that includes the price, weight, purity, and description of the gold item you’re buying. This protects you in case of any issues with the purchase.

c. Secure Payment: Use secure payment methods and avoid carrying large amounts of cash. Many dealers accept credit or debit cards, which offer an added layer of security.

6. Storing Your Gold

Once you’ve purchased your gold, consider how you’ll store it. Options include:

- Safe Deposit Boxes: Offered by banks, these provide high security but come with rental fees.

- Home Safes: If you choose to store gold at home, invest in a high-quality safe that’s both fireproof and burglar-resistant.

- Vault Storage Services: Some companies specialize in storing precious metals and offer insurance for added peace of mind.

Reasons To Buy Gold Today

Why You Should Consider Buying Gold Today: Key Reasons to Invest Now

Gold has been a prized asset throughout history, and today, it remains a popular choice for investors and collectors alike. If you’re contemplating adding gold to your investment portfolio or personal collection, there are several compelling reasons to consider making your move now. Let’s explore why buying gold today could be a wise decision.

**1. Economic Uncertainty and Inflation Hedge

a. Inflation Protection: In times of economic instability and rising inflation, gold has traditionally served as a hedge against the eroding value of fiat currencies. When inflation increases, the purchasing power of money decreases, but gold tends to retain its value. Investing in gold can protect your wealth from inflationary pressures.

b. Economic Downturns: Economic uncertainty, including potential recessions or financial crises, can lead to market volatility. Gold often performs well during such periods, providing a safe haven for investors looking to preserve their capital.

**2. Diversification of Investment Portfolio

a. Risk Reduction: Gold is a non-correlated asset, meaning its price movements are generally independent of stock and bond markets. Including gold in your investment portfolio can reduce overall risk and volatility, helping to stabilize your returns.

b. Long-Term Value: Historically, gold has demonstrated resilience and long-term growth. By diversifying your portfolio with gold, you can balance your investments and potentially enhance your overall returns.

**3. Potential for Appreciation

a. Market Demand: Increasing demand for gold in various sectors, including technology and jewelry, can drive up prices. Additionally, central banks around the world continue to hold and acquire gold as part of their reserves, which can influence market dynamics positively.

b. Supply Constraints: Gold mining is a complex and resource-intensive process. Limited new supply coupled with steady or increasing demand can contribute to higher gold prices over time.

**4. Safe Haven Asset

a. Geopolitical Tensions: Gold is often viewed as a safe haven during times of geopolitical uncertainty or global conflicts. Investors flock to gold to safeguard their assets from potential economic disruptions caused by such events.

b. Currency Fluctuations: As a global asset, gold is not tied to any single currency. This makes it an attractive option during periods of currency devaluation or volatility, providing stability against currency risks.

**5. Tangible and Liquid Investment

a. Physical Asset: Unlike digital or paper assets, physical gold can be held, stored, and directly owned. This tangibility provides a sense of security and control over your investment.

b. Liquidity: Gold is a highly liquid asset, meaning it can be easily bought or sold in most markets around the world. Whether you need to sell quickly or hold for the long term, gold offers flexibility in terms of liquidity.

**6. Historical and Cultural Significance

a. Legacy and Tradition: Gold has been cherished for thousands of years for its beauty and value. Owning gold can connect you with a rich historical tradition and cultural legacy that spans across civilizations.

b. Collectible Value: Beyond its investment potential, gold can also hold collectible value. Coins, bars, and jewelry often have additional historical or artistic significance, adding to their overall worth.

**7. Inflation-Protected Retirement Savings

a. Retirement Diversification: As part of a diversified retirement strategy, gold can offer protection against inflation and economic downturns. Including gold in your retirement savings can enhance financial security for the future.

b. Long-Term Security: Gold’s potential for appreciation and stability makes it a prudent choice for long-term investment goals, including retirement planning.

Conclusion

Buying gold today offers numerous benefits, from protecting against inflation and economic uncertainty to diversifying your investment portfolio and ensuring long-term financial security. Whether you’re an experienced investor or new to the world of precious metals, considering gold as part of your financial strategy can provide both safety and potential for growth.