A Guide to Buying Gold from East Africa

East Africa has emerged as a significant player in the global gold market, attracting investors, jewelers, and traders alike. Rich in mineral resources, the region is home to some of the most promising gold mining countries like Tanzania, Kenya, Uganda, and Ethiopia. If you’re considering purchasing gold from East Africa, this guide will walk you through the essential steps and considerations to ensure a smooth and secure transaction.

1. Understanding the Market

East Africa’s gold market is diverse, with numerous sources ranging from large-scale mines to small artisanal miners. The quality of gold, its purity, and the method of extraction can vary significantly. Generally, gold from East Africa is available in the form of nuggets, dore bars (a semi-pure alloy of gold and silver), or refined bars.

It’s crucial to research the current market prices and trends, as gold prices can fluctuate due to global economic factors. Websites like Kitco or the London Bullion Market Association (LBMA) provide up-to-date information on gold prices.

2. Choosing a Reliable Supplier

Selecting a trustworthy supplier is perhaps the most critical step in buying gold from East Africa. Here are some tips to help you find a reliable source:

- Check Credentials: Ensure the supplier is licensed to trade in gold and has a solid reputation. Verify their credentials through local authorities or industry bodies.

- Visit the Operation: If possible, visit the mining site or the supplier’s operation. This not only helps establish trust but also gives you a better understanding of the source of the gold.

- Seek Recommendations: Networking with industry professionals or seeking recommendations from established players in the market can lead you to reputable suppliers.

3. Legal and Regulatory Compliance

Compliance with legal and regulatory requirements is crucial to avoid potential pitfalls. Each East African country has its own regulations governing gold exports. Key aspects to consider include:

- Export Licenses: Ensure that the supplier holds the necessary export licenses. These licenses are typically issued by the government or relevant mining authorities.

- Documentation: Ensure all transactions are documented, including proof of origin, assay reports, and export permits. This not only helps in complying with international regulations but also in verifying the gold’s authenticity.

- Taxation and Duties: Be aware of any taxes or duties that may apply to gold exports. Some countries may offer tax incentives or exemptions for exporting gold, but it’s essential to verify this with local authorities.

4. Due Diligence and Risk Management

Conducting thorough due diligence is vital to mitigating risks. Here are some steps to ensure you’re making a safe investment:

- Assay Testing: Before purchasing, consider having the gold independently tested for purity. Assay tests confirm the gold’s quality and help avoid potential scams.

- Secure Payment Methods: Use secure payment methods such as escrow services or bank guarantees to protect your funds until the gold is delivered and verified.

- Understand the Political and Economic Environment: The political and economic stability of the source country can impact the gold trade. Stay informed about the region’s geopolitical situation to avoid disruptions in your supply chain.

5. Logistics and Transportation

Transporting gold from East Africa to your destination requires careful planning:

- Secure Transportation: Use reputable logistics companies experienced in transporting precious metals. Ensure the gold is insured during transit to protect against loss or theft.

- Customs and Import Regulations: Be aware of the customs requirements in both the exporting and importing countries. Some countries may have restrictions or require special permits for importing gold.

6. Ethical Considerations

Ethical sourcing is becoming increasingly important in the gold industry. Ensure that the gold you purchase is not linked to illegal mining or human rights abuses. Look for suppliers who adhere to responsible mining practices and who can provide certification of ethical sourcing.

Understanding the Different Types of Gold Available in East Africa

1. Gold Nuggets

Gold nuggets are naturally occurring pieces of native gold. They are found in riverbeds, alluvial deposits, or extracted directly from the earth during mining operations. These nuggets vary in size and purity, often ranging from small, pea-sized pieces to larger chunks weighing several grams or more.

- Purity: The purity of gold nuggets can vary significantly, typically ranging from 70% to 90% gold, with the remainder consisting of other metals like silver and copper.

- Uses: Due to their natural and unique shapes, gold nuggets are often sought after by collectors and jewelers who appreciate their raw, unrefined beauty.

2. Gold Dore Bars

Gold dore bars are semi-pure alloys of gold and silver, produced by miners as an intermediate product. These bars are usually refined further to produce pure gold.

- Purity: Dore bars typically contain between 60% to 95% gold, depending on the refining process used by the miners. The rest of the bar is composed of silver, copper, and other trace metals.

- Uses: Dore bars are usually sold to refineries where they are processed into pure gold bars or used in the production of jewelry and other gold products.

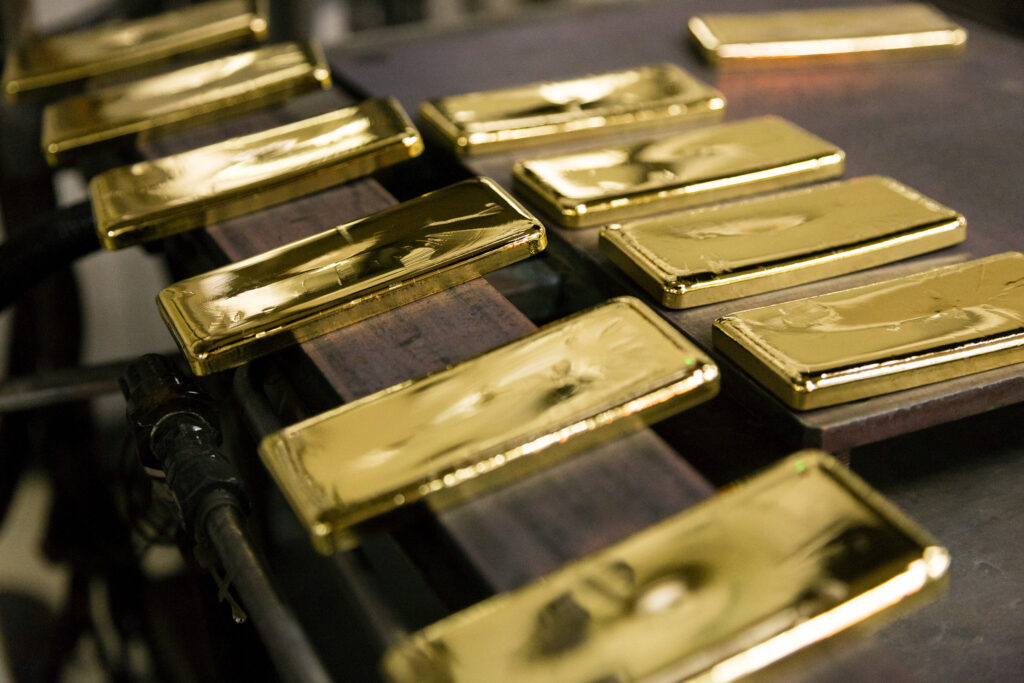

3. Refined Gold Bars

Refined gold bars, also known as bullion, are the most common form of gold traded internationally. These bars are produced in refineries where gold dore is processed to achieve high levels of purity.

- Purity: Refined gold bars typically have a purity of 99.5% to 99.99%, depending on the refining process. The highest purity bars are often referred to as “four nines” (99.99% pure).

- Uses: Refined gold bars are the standard in the international gold market and are used for investment purposes, central bank reserves, and large-scale jewelry manufacturing.

4. Gold Dust

Gold dust refers to fine particles of gold that are found in the same locations as gold nuggets. These particles are usually recovered during alluvial gold mining operations.

- Purity: The purity of gold dust can vary widely, depending on its source. It may require further processing to remove impurities and achieve higher purity levels.

- Uses: Gold dust is typically collected and refined into gold bars or used in the production of jewelry. Due to its fine nature, it is often more difficult to handle and transport compared to larger nuggets or dore bars.

5. Gold Jewelry and Artifacts

In East Africa, gold is not only mined for industrial and investment purposes but is also crafted into intricate jewelry and artifacts. Traditional goldsmiths in countries like Ethiopia and Kenya create beautiful pieces that reflect the region’s rich cultural heritage.

- Purity: The purity of gold jewelry can range from 18 karats (75% pure gold) to 24 karats (99.9% pure gold), depending on the craftsmanship and the intended market.

- Uses: Gold jewelry and artifacts are not only worn and used as decorations but are also seen as a store of value and a form of investment, particularly in local markets.

6. Recycled Gold

Recycled gold refers to gold that has been reclaimed from previously used items, such as old jewelry, electronics, or industrial products. This type of gold is increasingly important in the market as sustainability and ethical sourcing gain more attention.

- Purity: The purity of recycled gold depends on the refining process it undergoes. It can be refined to achieve high purity levels similar to newly mined gold.

- Uses: Recycled gold is used in the production of new jewelry, electronics, and investment products, contributing to a more sustainable gold market.

The Benefits of Buying Gold Directly from East Africa

1. Access to High-Quality Gold

East Africa is home to some of the world’s richest gold deposits, particularly in countries like Tanzania, Uganda, and Kenya. The region’s gold is known for its high purity levels, often requiring minimal refining before it can be used in jewelry or other applications.

- Unrefined Quality: Purchasing gold in its raw form, such as nuggets or dore bars, allows buyers to access high-quality gold at a lower cost before it undergoes further refining.

- Diverse Forms: The region offers various forms of gold, including nuggets, dore bars, refined bullion, and artisanal jewelry, providing buyers with a range of options to suit their specific needs.

2. Competitive Pricing

One of the most compelling reasons to buy gold directly from East Africa is the potential for competitive pricing. By purchasing gold at the source, buyers can often secure better deals compared to buying through intermediaries or on the international market.

- Lower Cost: Buying directly from miners or local suppliers can eliminate the markups added by middlemen, reducing the overall cost of gold.

- Price Negotiation: Direct transactions allow for better price negotiations, particularly when dealing with artisanal miners or smaller suppliers.

3. Supporting Local Economies

Purchasing gold directly from East Africa contributes to the economic development of the region. Many gold mining communities rely heavily on the income generated from gold sales.

- Community Impact: By buying directly, you help support local miners and their communities, ensuring that a larger portion of the proceeds stays within the region.

- Sustainable Development: Ethical buyers can promote sustainable and responsible mining practices by engaging with suppliers who prioritize environmental and social responsibility.

4. Ethical Sourcing Opportunities

East Africa offers opportunities for buyers to engage in ethical sourcing practices. By working directly with miners and suppliers who adhere to responsible mining standards, buyers can ensure that their gold is sourced in a way that minimizes environmental impact and supports fair labor practices.

- Transparency: Direct transactions often provide greater transparency, allowing buyers to verify the source of the gold and ensure it meets ethical standards.

- Certifications: Many suppliers in the region are increasingly seeking certifications, such as Fairtrade or Fairmined, which guarantee that the gold has been produced under strict ethical guidelines.

5. Customization and Flexibility

Buying gold directly from the source provides greater flexibility in terms of the quantity, quality, and form of gold purchased. This is particularly advantageous for jewelers or manufacturers looking for specific types of gold for their products.

- Tailored Orders: Buyers can request specific quantities, purity levels, or forms of gold, such as refined bars, nuggets, or customized pieces of jewelry.

- Direct Communication: Working directly with suppliers allows for better communication and the ability to tailor orders to meet specific requirements.

6. Investment Potential

Purchasing gold directly from East Africa can be a lucrative investment opportunity. The region’s gold is often available at lower prices, allowing investors to potentially benefit from price appreciation as gold prices rise globally.

- Potential for High Returns: Investing in gold from East Africa can offer high returns, especially when purchased at a lower cost directly from the source.

- Diversification: For investors, adding gold from East Africa to their portfolio can provide diversification, helping to reduce risk and enhance overall investment performance.

7. Cultural and Historical Value

East Africa has a rich cultural heritage, and its gold is often crafted into unique and intricate pieces of jewelry and artifacts. For collectors and jewelers, buying directly from the region offers access to culturally significant items that are not available elsewhere.

- Unique Artistry: Artisans in East Africa create gold jewelry and artifacts that reflect the region’s cultural and historical traditions, offering buyers one-of-a-kind pieces.

- Cultural Connection: Owning gold from East Africa can provide a deeper connection to the region’s history and culture, adding intangible value to the purchase.

Buying gold directly from East Africa offers a range of benefits, from competitive pricing and high-quality gold to the opportunity to support local economies and engage in ethical sourcing practices. Whether you are an investor looking for potential returns, a jeweler seeking unique materials, or a conscious consumer interested in sustainable sourcing, East Africa presents a compelling option for acquiring gold. By understanding these advantages, you can make informed decisions and capitalize on the opportunities that this resource-rich region has to offer.