Buy Gold In Malaysia, physical gold comes in many forms such as gold bars, gold coins and even gold jewellery. It might come as a shock to you that some people prefer physical gold more in this digital age, right? Well, some do prefer it more because of its unique properties such as its size and design.

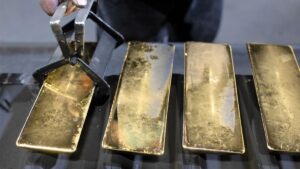

Gold bars

Usually the first choice for experienced investors.There’re various sizes of gold bars (ranging from 25g to 1kg). As it’s larger than gold coins, it’s easy to store and an effective option for investment if you’re looking to make a sizable one (read: big profits!). One gold bar could cost you thousands to hundreds of thousands ringgit.

The downside is that gold bars aren’t a convenient option to liquidate (read: sell to get money). Let’s say you’ve 1kg of gold bars and you intend to liquidate your gold. The only option you’ve is to liquidate all 1kg. It’s not like you can slice it and only liquidate a quarter of it, right?

Gold coins

A more convenient investment option due to its size and it’s easy to sell it whenever you need money (liquidate). It usually weighs between 2.5g and 25g of pure gold. It’s also an ideal investment option for new investors that’re trying to get their feets wet.

The price for one gold coin could be between hundreds to thousands ringgit. Here’s a fun fact, sometimes the gold coin is valued higher due to its being individually minted. Therefore, it makes it more authentic and expensive.

#1 Increased Interest In Gold Bar

You can invest in gold by purchasing physical gold bars, bullion coins or jewelry. There are a few places where one can buy physical gold bar and bullion including banks and gold shops. You can purchase the Ki Gold Bullion Coins that are minted by the Royal Mint of Malaysia from Maybank and Bumiputra Commerce Bank.

They come in sizes of 1 troy ounce (31.105g), ½ troy ounce (15.550g) and ¼ troy ounce (7.780g) and prices are pegged to the international gold price. You can keep your gold bars and bullion in safe deposit boxes in banks for a fee.

#2 Trade Gold At Daily Rates

There are less literal ways of trading gold – which means investors can still tap into the value of the commodity without having to buy physical gold and worry about its safekeeping. Many banks in Malaysia let customers buy and sell gold at daily rates to make a profit through a gold investment account.

#3 Invest In Gold Mining Companies

One way to invest in gold is to buy the shares of companies that mine them. Depending on the performance of these companies, investors make a profit or loss. Some bigger companies even provide dividends to investors for holding their shares.

One of the gold mining companies in Malaysia is the Poh Kong Holdings Berhad and its share price is RM0.86 at the time of writing. When investing in a gold mining company instead of the commodity itself, investors need to consider the company’s performance and market risks.

In the past, investors have witnessed gold prices increase when the stock market is not doing well. Some investors would buy gold in economic downturns. There are risks with investing in gold in that the price of gold has been shown to be quite volatile, relying on the supply and demand for it.

Should You Invest In Gold?

After thousands of years, gold still holds its value. People around the world invest in gold to hedge against market and inflation risks. In the past, gold prices bucked the trend, rising when financial markets and currencies didn’t do well,message us.